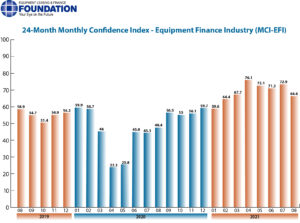

The Monthly Confidence Index for the equipment finance industry (MCI-EFI), published by the Equipment Leasing & Finance Foundation (ELFF), indicated a decline in August relative to July. The August index was at 66.6, a decrease from 72.9 in July.

The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector.

Potential tax increases and the political landscape at the federal and state levels are issues of concern, according to MCI-EFI survey respondent Dave Fate, CEO of Stonebriar Commercial Finance, Plano, Texas.

“I have been optimistic on the near and long-term future of the equipment leasing and finance industry,” Fate said. “As was proven out during 2020, secured loans and leases always outperform all other asset classes. In my opinion that will never change. My only concerns are things outside of our control, such as the potential increase in tax rates and the political landscape that exists today both at the federal and state levels.”

When asked to assess their business conditions over the next four months, 35.7 percent of executives responding said they believe business conditions will improve over the next four months, down from 58.6 percent in July, and 64.3 percent believe business conditions will remain the same over the next four months, up from 41.4 percent the previous month. None believe business conditions will worsen, unchanged from July.

- Of the survey respondents, 32.1 percent believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 55.2 percent in July, and 67.9 percent believe demand will “remain the same” during the same four-month time period, an increase from 41.4 percent the previous month. None believe demand will decline, down from 3.5 percent in July.

- Of the respondents, 28.6 percent expect more access to capital to fund equipment acquisitions over the next four months, down from 37.9 percent in July, and 71.4 percent of executives indicate they expect the “same” access to capital to fund business, an increase from 62.1 percent last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 35.7 percent of the executives reported they expect to hire more employees over the next four months, down from 37.9 percent in July, and 64.3 percent expect no change in headcount over the next four months, an increase from 62.1 percent last month. None expect to hire fewer employees, unchanged from July.

- Only 14.3 percent of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 27.6 percent the previous month and 85.7 percent of the leadership evaluate the current U.S. economy as “fair,” up from 72.4 percent in July. None evaluate it as “poor,” unchanged from last month.

- Only 32.1 percent of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 48.3 percent in July, and 64.3 percent indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 51.7 percent last month. 3.6 percent believe economic conditions in the U.S. will worsen over the next six months, up from none the previous month.

- In August 50 percent of respondents indicated they believe their company will increase spending on business development activities during the next six months, down from 51.7 percent last month and 50 percent believe there will be “no change” in business development spending, an increase from 48.3 percent in July. None believe there will be a decrease in spending, unchanged from last month.

“I think we are currently chopping wood and grinding through an abundance of liquidity, supply chain disruptions, ever narrowing margins and competitive recruiting environments,” said David Normandin, president and CEO, Wintrust Specialty Finance, Irvine, California. “This will continue for the near future and our industry will adapt and find ways to win.”

Michael Romanowski, president of Farm Credit Leasing, of Minneapolis, Minnesota., said business growth is solid, but is somewhat hampered by supply chain challenges.

Respondents to the MCI-EFI are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents and captive equipment finance companies.

Follow us on social media: