Citing “unprecedented market decline” related to the government’s Covid-19 shut-downs, Verso Corp. said it is indefinitely closing its printing and writing paper mills in Duluth, Minn. and Wisconsin Rapids, Wisc.

The company said it will explore viable and sustainable alternatives for both mills, including restarting if market conditions improve, marketing for sale or closing permanently.

“The decision to reduce production capacity is driven by the accelerated decline in graphic paper demand resulting from the Covid-19 pandemic,” Verso said in a statement. “The stay-at-home orders have significantly reduced the use of print advertising in various industries, including retail, sports, entertainment and tourism.”

Verso said North American printing and writing demand fell by 38 percent year-over-year in April, and operating rates are expected to drop well below 70 percent during the second quarter.

“It is critical that we maintain a healthy balance sheet and focus on cash flow, while balancing our supply of products and our customers’ demand,” said Adam St. John, president and CEO. “After a comprehensive review of post-pandemic demand forecasts and capacity, we made the difficult decision to idle the Duluth and Wisconsin Rapids mills. We expect the idling of these facilities to improve our free cash flow. The sell through of inventory is expected to offset the cash costs of idling the mills.”

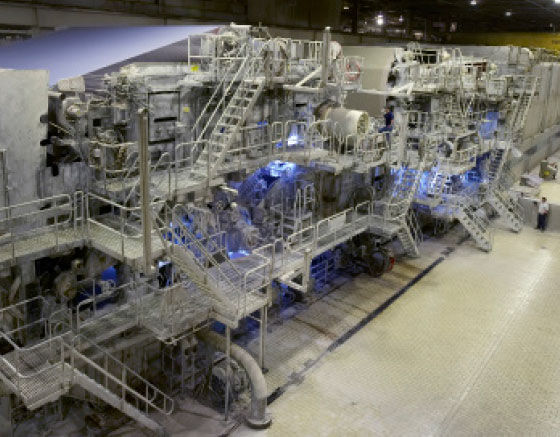

Verso expects to idle the Duluth mill by the end of June and the Wisconsin Rapids Mill by the end of July, resulting in the layoff of about 1,000 employees. The Duluth mill produced 270,000 tons of paper annually, while the Wisconsin Rapids mill produced 540,000 tons per year.

Verso will continue to supply graphic and specialty papers in roll and sheet form, as well as packaging papers and pulp. The company operates mill in Escanaba and Quinnesec, Mich.

Although Verso said re-opening or a sale of the mills is possible, Mark Wilde, industry analyst for BMO Capital Markets, said “the long-term decline in paper demand will leave a dark cloud of uncertainty hanging over both mills and their workers. Unfortunately, many other mills are also looking for new owners and new markets.”

Wilde added that the idling at Duluth suggests that an earlier Verso proposal to convert the mill to a combination of recycled kraft paper and containerboard is off the table.

Follow us on social media: